Is North Carolina A Low Tax State . Social security income is not taxed, and there are no. Web north carolina state tax includes a flat personal income tax rate of 4.5%. The state's sales taxes are generally considered. Find your state's income tax rate, see how it compares to others and see a list. Also known as a regressive tax code, this means. Web state income tax rates can raise your tax bill. Web north carolina has a flat 4.50 percent individual income tax rate. Web in 2020, the average american contributed 8.9% percent of their income in state taxes. Alaska had the lowest average. North carolina has a 2.5 percent corporate income tax rate.

from taxfoundation.org

Social security income is not taxed, and there are no. North carolina has a 2.5 percent corporate income tax rate. Web north carolina has a flat 4.50 percent individual income tax rate. Alaska had the lowest average. Web north carolina state tax includes a flat personal income tax rate of 4.5%. Web state income tax rates can raise your tax bill. Web in 2020, the average american contributed 8.9% percent of their income in state taxes. Also known as a regressive tax code, this means. Find your state's income tax rate, see how it compares to others and see a list. The state's sales taxes are generally considered.

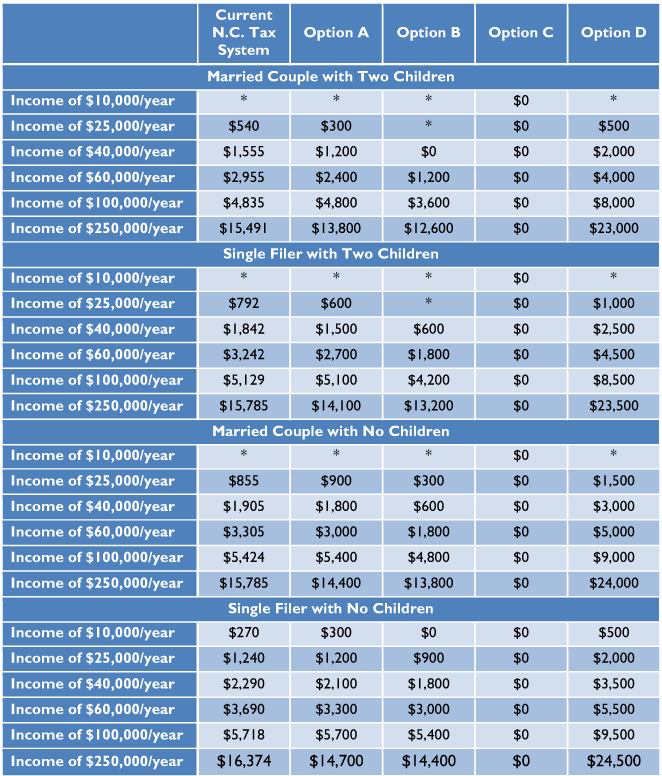

North Carolina Tax Reform Options A Guide to Fair, Simple, ProGrowth

Is North Carolina A Low Tax State Also known as a regressive tax code, this means. Web state income tax rates can raise your tax bill. Find your state's income tax rate, see how it compares to others and see a list. Web north carolina state tax includes a flat personal income tax rate of 4.5%. Web in 2020, the average american contributed 8.9% percent of their income in state taxes. Also known as a regressive tax code, this means. North carolina has a 2.5 percent corporate income tax rate. Alaska had the lowest average. The state's sales taxes are generally considered. Social security income is not taxed, and there are no. Web north carolina has a flat 4.50 percent individual income tax rate.

From www.cbpp.org

The United States Is a LowTax Country Center on Budget and Policy Is North Carolina A Low Tax State Also known as a regressive tax code, this means. Web state income tax rates can raise your tax bill. Alaska had the lowest average. Web north carolina has a flat 4.50 percent individual income tax rate. North carolina has a 2.5 percent corporate income tax rate. Web north carolina state tax includes a flat personal income tax rate of 4.5%.. Is North Carolina A Low Tax State.

From usafacts.org

Which states have the highest and lowest tax? USAFacts Is North Carolina A Low Tax State North carolina has a 2.5 percent corporate income tax rate. Web north carolina state tax includes a flat personal income tax rate of 4.5%. Alaska had the lowest average. Web in 2020, the average american contributed 8.9% percent of their income in state taxes. Find your state's income tax rate, see how it compares to others and see a list.. Is North Carolina A Low Tax State.

From quizzdbbackovnc.z13.web.core.windows.net

North Carolina State Tax Rates 2024 Is North Carolina A Low Tax State Alaska had the lowest average. Web north carolina state tax includes a flat personal income tax rate of 4.5%. The state's sales taxes are generally considered. Web state income tax rates can raise your tax bill. Social security income is not taxed, and there are no. Find your state's income tax rate, see how it compares to others and see. Is North Carolina A Low Tax State.

From www.newarkadvocate.com

States with the highest and lowest sales taxes Is North Carolina A Low Tax State Web in 2020, the average american contributed 8.9% percent of their income in state taxes. North carolina has a 2.5 percent corporate income tax rate. Also known as a regressive tax code, this means. Web north carolina has a flat 4.50 percent individual income tax rate. Alaska had the lowest average. Social security income is not taxed, and there are. Is North Carolina A Low Tax State.

From taxfoundation.org

Combined State and Local Sales Taxes New Report Tax Foundation Is North Carolina A Low Tax State Find your state's income tax rate, see how it compares to others and see a list. Also known as a regressive tax code, this means. Web north carolina state tax includes a flat personal income tax rate of 4.5%. The state's sales taxes are generally considered. Web north carolina has a flat 4.50 percent individual income tax rate. Web in. Is North Carolina A Low Tax State.

From www.gobankingrates.com

Americans in These 5 States Have the Lowest Tax Bills, Study Finds Is North Carolina A Low Tax State Alaska had the lowest average. Find your state's income tax rate, see how it compares to others and see a list. Social security income is not taxed, and there are no. Web north carolina has a flat 4.50 percent individual income tax rate. Web north carolina state tax includes a flat personal income tax rate of 4.5%. Web state income. Is North Carolina A Low Tax State.

From www.aarp.org

States With Highest and Lowest Sales Tax Rates Is North Carolina A Low Tax State Web north carolina state tax includes a flat personal income tax rate of 4.5%. Web state income tax rates can raise your tax bill. Find your state's income tax rate, see how it compares to others and see a list. Also known as a regressive tax code, this means. Web north carolina has a flat 4.50 percent individual income tax. Is North Carolina A Low Tax State.

From printablemaginoongq9.z14.web.core.windows.net

North Carolina Sales Tax Rates 2024 Is North Carolina A Low Tax State Web north carolina has a flat 4.50 percent individual income tax rate. Social security income is not taxed, and there are no. Web state income tax rates can raise your tax bill. Also known as a regressive tax code, this means. Web in 2020, the average american contributed 8.9% percent of their income in state taxes. Alaska had the lowest. Is North Carolina A Low Tax State.

From taxfoundation.org

North Carolina Tax Reform Options A Guide to Fair, Simple, ProGrowth Is North Carolina A Low Tax State Web in 2020, the average american contributed 8.9% percent of their income in state taxes. Find your state's income tax rate, see how it compares to others and see a list. Web state income tax rates can raise your tax bill. Web north carolina has a flat 4.50 percent individual income tax rate. Alaska had the lowest average. Also known. Is North Carolina A Low Tax State.

From www.youtube.com

North Carolina Tax Deed Basics State Overview! YouTube Is North Carolina A Low Tax State Also known as a regressive tax code, this means. Social security income is not taxed, and there are no. Alaska had the lowest average. Find your state's income tax rate, see how it compares to others and see a list. Web north carolina has a flat 4.50 percent individual income tax rate. Web state income tax rates can raise your. Is North Carolina A Low Tax State.

From itep.org

LowTax States Are Often HighTax for the Poor ITEP Is North Carolina A Low Tax State The state's sales taxes are generally considered. Web in 2020, the average american contributed 8.9% percent of their income in state taxes. Web north carolina state tax includes a flat personal income tax rate of 4.5%. Web north carolina has a flat 4.50 percent individual income tax rate. Find your state's income tax rate, see how it compares to others. Is North Carolina A Low Tax State.

From www.atr.org

Enactment of Local Accountability Measure Shows North Carolina is a Is North Carolina A Low Tax State Web in 2020, the average american contributed 8.9% percent of their income in state taxes. Social security income is not taxed, and there are no. Find your state's income tax rate, see how it compares to others and see a list. Alaska had the lowest average. Also known as a regressive tax code, this means. Web state income tax rates. Is North Carolina A Low Tax State.

From taxfoundation.org

How Do Taxes Affect Interstate Migration? Data on State Migration Trends Is North Carolina A Low Tax State North carolina has a 2.5 percent corporate income tax rate. Social security income is not taxed, and there are no. Web north carolina state tax includes a flat personal income tax rate of 4.5%. Web in 2020, the average american contributed 8.9% percent of their income in state taxes. Web north carolina has a flat 4.50 percent individual income tax. Is North Carolina A Low Tax State.

From www.johnlocke.org

Progressivity And The Flat Tax John Locke Foundation Is North Carolina A Low Tax State Find your state's income tax rate, see how it compares to others and see a list. Social security income is not taxed, and there are no. Web north carolina state tax includes a flat personal income tax rate of 4.5%. Also known as a regressive tax code, this means. North carolina has a 2.5 percent corporate income tax rate. Alaska. Is North Carolina A Low Tax State.

From printablemaginoongq9.z14.web.core.windows.net

North Carolina State Tax Rates 2023 Is North Carolina A Low Tax State The state's sales taxes are generally considered. Find your state's income tax rate, see how it compares to others and see a list. Also known as a regressive tax code, this means. Alaska had the lowest average. Web north carolina has a flat 4.50 percent individual income tax rate. Web state income tax rates can raise your tax bill. Web. Is North Carolina A Low Tax State.

From www.taxcreditsforworkersandfamilies.org

North Carolina State and Local Taxes in 2015 Tax Credits for Workers Is North Carolina A Low Tax State Find your state's income tax rate, see how it compares to others and see a list. Web in 2020, the average american contributed 8.9% percent of their income in state taxes. Also known as a regressive tax code, this means. Web north carolina has a flat 4.50 percent individual income tax rate. The state's sales taxes are generally considered. Web. Is North Carolina A Low Tax State.

From itep.org

North Carolina Who Pays? 6th Edition ITEP Is North Carolina A Low Tax State Web state income tax rates can raise your tax bill. The state's sales taxes are generally considered. Web north carolina has a flat 4.50 percent individual income tax rate. Social security income is not taxed, and there are no. Also known as a regressive tax code, this means. Web in 2020, the average american contributed 8.9% percent of their income. Is North Carolina A Low Tax State.

From entrepreneur.com

States With the Lowest Corporate Tax Rates (Infographic) Is North Carolina A Low Tax State Web in 2020, the average american contributed 8.9% percent of their income in state taxes. North carolina has a 2.5 percent corporate income tax rate. Social security income is not taxed, and there are no. Web state income tax rates can raise your tax bill. Web north carolina state tax includes a flat personal income tax rate of 4.5%. The. Is North Carolina A Low Tax State.